The Complete Turtle Trader: The Legend, The Lesson, The Results

Michael W. Covel

Published by Collins

Copyright: © 2007

(Note: This is the second of 3 reviews detailing the stories and methods of stock market trend followers and traders that collectively became known as ‘Turtles’.)

Michael W. Covel, 54, born in Virgina, is an author of 8 books on markets and trading with a specialization in the market technical analysis known as trend following or ‘Turtle’ trading.

He also hosts a podcast, ‘Trend Following Radio‘, which to date has recorded more than 1200 episodes. The podcast follows a format of interviewing leading authorities in economics, trading, and various other topics of interest to the investment world.

The previous post, ‘Turtle of the First’ was from the perspective of Curtis Faith who, in 1984, began his trading career in the first class of Richard Dennis’ ‘Turtles’. Michael Covel’s book is from the perspective of an outsider looking in. Before moving onto Covel’s story a quick recap from the previous post.

In 1983 Richard J. Dennis and his partner at C&D Commodities, their Chicago trading firm, budgeted $15,000 to run a recruitment ad in the Wall Street Journal, Barrons, and the International Herald Tribune seeking recruits to train in futures trading:

…Mr. Dennis and his associates will train a small group of applicants in his proprietary trading concepts. Successful candidates will then trade solely for Mr. Dennis: they will not be allowed to trade futures for themselves or others. Traders will be paid a percentage of their trading profits, and will be allowed a small draw. Prior experience in trading will be considered, but is not necessary. Applicants should send a brief resume with one sentence giving their reasons for applying…

From Richard J. Dennis et al ad in the above-mentioned newspapers and magazine.

From the replies to his ad Dennis chose 23 inductees into the ‘Turtle’ program that included college graduates with degrees in accounting, business, economics, geology, linguistics, marketing, music, and the US Naval Academy. Those from the paycheck world he picked a security guard, salesperson, broker, phone clerk, bartender, board game designer, and someone who listed himself as unemployed. An eclectic bunch for a very structured task indeed.

Dennis was looking for high IQ types willing to break from the herd and take risks. Intelligently calculated risks to be precise.

Dennis and his partner William Eckhardt taught the students in a conference room, not the trading pits, all they needed to trade in two weeks. Each student received $1 million to trade and was allowed to keep 15% of the profits.

They had one objective. Make as much money trading, on their terms, as humanly possible. It was definitely high risk, but the rewards were commiserate. The persistent need to win was mandatory if they were to survive as a ‘Turtle’.

Dennis insisted that to win, his students must always question conventional wisdom. He knew from experience in the trading pits that the majority opinion was wrong a majority of the time along with information coming from the news sources.

‘Turtles’ were discouraged from following the news, reading economic reports, or collecting stock tips because the markets move faster than information can be assimilated into the market. Or in other words information didn’t move the markets; people trading, often irrationally, did.

Conventional wisdom on Wall Street was to buy low and sell high. ‘Turtles’ tossed the conventional wisdom, bought high, and sold higher or shorted new lows.

Dennis and Eckhardt taught the ‘Turtles’ to follow the trend. They waited for the market to move then they followed it. Capturing most of the trend, up or down, was the goal.

They determined when to buy high, or to short stocks going lower, by observing breakouts in the markets or securities. If a stock made a new 20 or 55 day high, they bought the stock. If it made a new 20 or 55 day low, they shorted the stock. If the trend continued in the desired direction, they bought, or shorted, more of the stock. When the trend ended they sold.

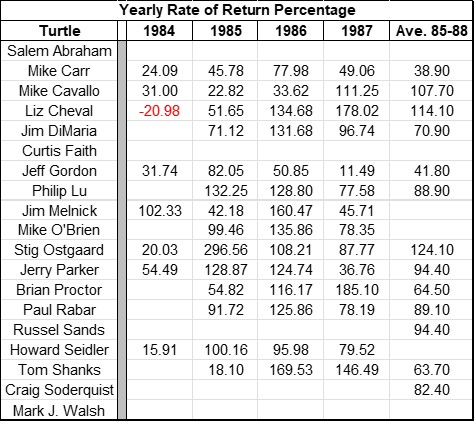

It was a simple system and it worked exceptionally well for the ‘Turtles’ who collectively made profits of $175,000,000 over the 5 years they worked for Dennis’s firm. The spreadsheet to the right shows the individual ‘Turtle’ results while they were working for Dennis (source: Covel and the Wall Street Journal – not all ‘Turtles’ listed)

Michael W. Covel Media:

- Trend Following: How Great Traders Make Millions in Up or Down Markets. Financial Times Management. 2004

- Trend Following: How Great Traders Make Millions in Up or Down Markets, New Expanded Edition. Financial Times. 2005

- The Complete TurtleTrader: The Legend, the Lessons, the Results. Collins. 2007

- Trend Following: Learn to Make Millions in Up or Down Markets, Updated Edition. Financial Times. 2009

- The Complete TurtleTrader: How 23 Novice Investors Became Overnight Millionaires: Paperback. Harper Business. 2009

- Trend Commandments: Trading for Exceptional Returns. Financial Times. 2011

- The Little Book of Trading: Trend Following Strategy for Big Winnings. Wiley. 2011

- Trend Following Analytics: Performance Proof for the World’s Most Controversial and Successful Black Swan Trading Strategy. Pearson Education. 2012

- Trend Following: How to Make a Fortune in Bull, Bear and Black Swan Markets, 5th Edition. Wiley. 2017

- Trend Following Mindset: The Genius of Legendary Trader Tom Basso. Harriman House. 2021

- Trend Following Masters – Volume 1: Trading Conversations. Harriman House. 2023

- Trend Following Masters – Volume 2: Trading Psychology Conversations. Harriman House. 2023

- Broke: The New American Dream. Film. 2011

- Michael Covel’s Trend Following. Podcast. 2012-2023

References and Readings:

- The Original Turtle Trading Rules. No personal attribution. Original Turtles.org. 2003

- Market Wizards: Interviews with Top Traders. By Jack D. Schwager. Wiley. 2006

- Who Were the Turtle Traders? No personal attribution. Managed Futures Trading. 2014

- Would the Turtle Trading System Work Now? By Ella Vincent. Trading SIM. 2020

- Turtle Trading: A Market Legend. By Michael Carr (Original Turtle). Investopedia. 2021

- Turtle Trading Tutorial. By Richard Cox. AskTraders. 2022

- Fundamental vs. Technical Analysis: What’s the Difference? By Christina Majaski. Investopedia. 2022

- Turtle Trading Rules: Does It Still Work Today? Rayner Teo. Trading with Rayner. 2022

- Turtle Trading: History, Strategy & Complete Rules. By Leo Smigel. Analyzing Alpha. 2023

- Turtle Trading Strategy: Richard Dennis Rules, Statistics, and Backtests – Does It Still Work? No personal attribution. Quantified Strategies. 2023

- Original Turtle Trading Rules & Philosophy. By Michael W. Covel. Turtle Trader. No date

- Turtle Trading: What Is It and What Are the Rules? No personal attribution. IG Markets Limited. No date

- Rules to Use Turtle Trading Strategy. No personal attribution. MTrading. No date